Preparing For AI-Driven FDA Regulatory Reviews

June 2025

The FDA’s recent launch of its Artificial Intellgence (AI) tool, Elsa, marks a historic shift in how life sciences companies will be evaluated. With AI helping regulators identify high-priority inspection targets, your quality management system (QMS) may either be your greatest asset—or your biggest liability.

This is just the start of the FDA’s AI journey. They expect the tool to mature and have plans to integrate more AI into different processes across the organization.

So, what does this mean for life sciences companies and what steps should your organization be taking to keep up with the pace of innovation?

AI Is Raising the Bar for Quality

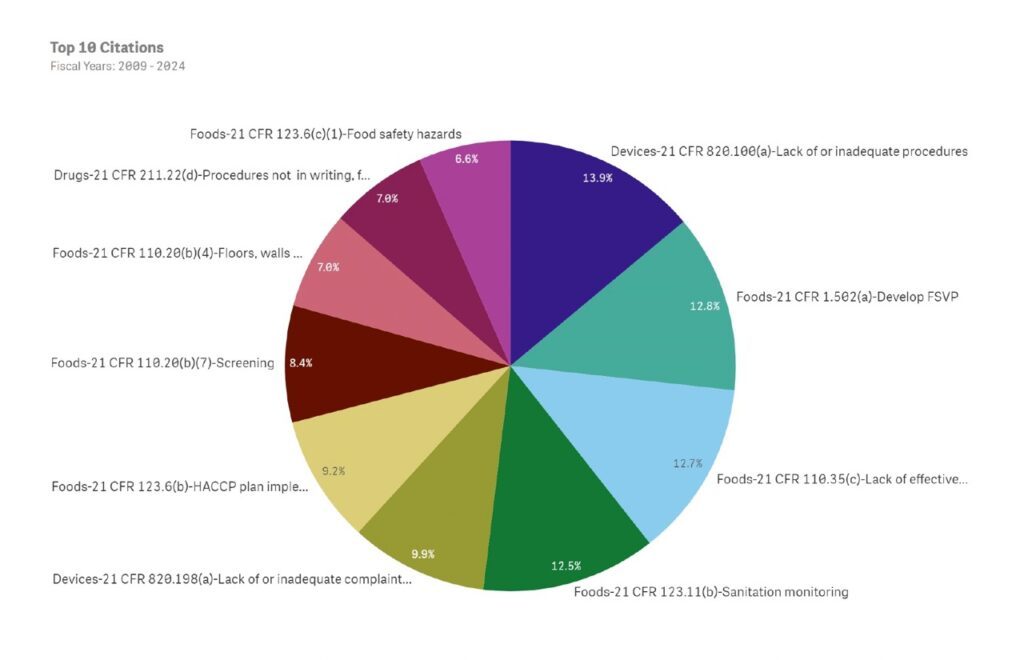

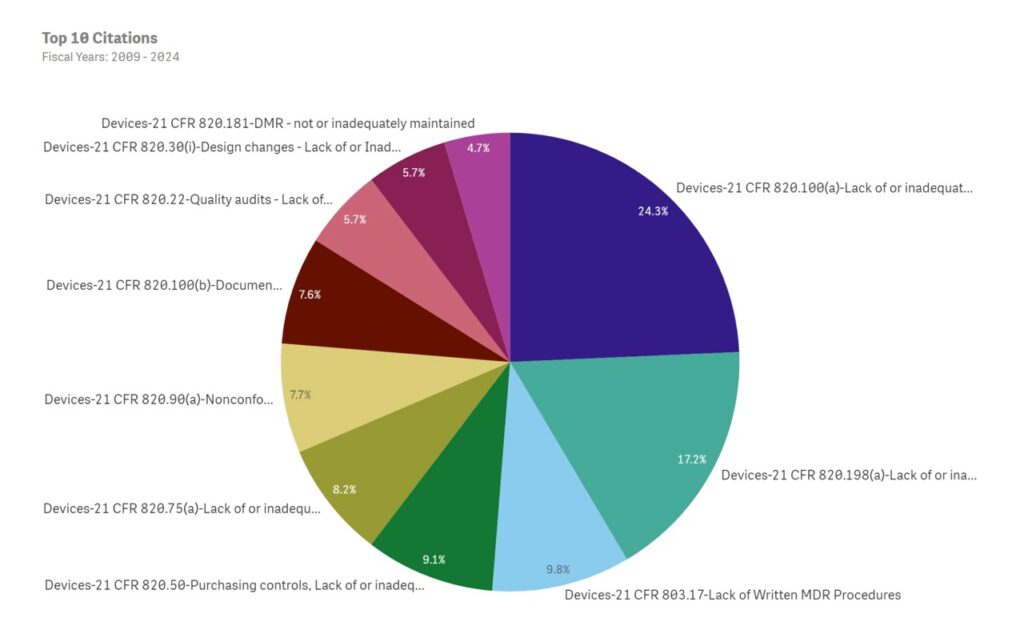

The use of AI opens the door for regulators to detect systemic issues, patterns of deviation handling, inconsistencies in CAPA closure, and more—at scale.

As the FDA continues expanding their AI capabilities, it is essential for quality teams to optimize their procedures and establish processes that detect and prevent issues from occurring.

The Risk of an Outdated QMS

If your QMS is still heavily manual, fragmented across departments, or lacks real-time documentation capabilities, you’re behind. AI-powered inspections will spotlight weak links in your processes that might previously have gone unnoticed.

Audit-readiness has never been so crucial, and to ensure your QMS is not at risk, consider assessing common vulnerabilities and areas for improvement.

Common vulnerabilities include:

- Incomplete audit trails

- Delayed or inconsistent deviation investigations

- Poorly linked quality events and CAPAs

- Non-standard data entry formats

- Paper-based records, manual data entry leads to inconsistencies

- Reactive compliance strategies

- Missing or inadequate procedures

What was once “good enough” might soon fall short of regulatory expectations.

Future-Proof Your Quality Systems with OQSIE

Now is the time to assess whether your systems are built for an AI-informed regulatory environment and start establishing procedures that promote continuous improvement. Here are three recommended steps you can take:

- Audit Your System: Assess gaps and identify steps for improvement in your current QMS.

- Modernize Your Infrastructure: Implement digital-first tools to streamline data traceability and accessibility.

- Strengthen Your Processes: Leverage AI and other advanced technology to streamline procedures and create a culture of continuous improvement with real-time and predictive data.

Regulators are turning to AI to keep up with the rapid innovation and complexity of the life sciences industry, and if your systems aren’t up to the same standard, you risk falling behind.

An AI-ready QMS doesn’t just protect you from noncompliance—it accelerates your path to market, boosts operational efficiency, and prepares you for whatever the future holds.

OQSIE has helped some of the most respected life sciences organizations enhance their quality systems. Let us help you stay ahead of the curve. Contact us to schedule a QMS Strategy Session.